Content

Since service companies don’t produce goods, the COGS is replaced by the cost of revenue, which is essentially the COGS for service companies. Beginning inventory is the merchandise that wasn’t sold in the previous year. Purchases during the period include the cost of producing more products or buying more merchandise. Also, EBIT is not an official GAAP measure, while operating income is an official GAAP measure. Subtract the operating income of the previous year from the current year’s operating income. Therefore, companies in such industries often report operating income that is significantly lower as compared to companies in other industries.

If a company’s operating income declines, profit loss might be a concern. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. However, EBITDA can sometimes https://quick-bookkeeping.net/can-law-firms-measure-ambition-without-billable/ be misleading because it doesn’t count the costs of capital investments. For instance, if a business has debt, the interest it pays the bank doesn’t come out of operating income.

Divi Marketplace

Additionally, management can use GOI to assess how well the company is performing compared to its peers. You can think of “cap rate” as a synonym for return on investment but it’s used widely in the real estate sphere. Certain numbers are excluded from NOI calculations because they do not support the purpose of net operating income . Remember, NOI takes into account all income, which is GOI plus any additional income a property makes. A property can make money outside of tenant rents in a variety of ways.

- These are the expenses that don’t directly go into the cost of creating the goods that were sold but are part of the normal running of the business.

- This leaves Linda with $100,000 to pay for interest on any loans plus taxes.

- You might see some rapid fluctuation between support and resistance, then a bull or bear flag.

- This calculation gives a good estimate of the company’s actual profits from its operations.

- A mistake many entrepreneurs make is believing that gross income is the most important indicator when it comes to business success.

Moreover, you should know how each impacts your financial statements. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective»), an SEC-registered investment adviser. Decreasing operating income is an indication that a company is losing its operating efficiency or it has added operating costs. This can be an easier way to understand how efficiently the company generates profits from its core business, as you can compare year-over-year or versus competitors.

Use Net Operating Income Formula

They will use the figure to evaluate the business’s efficiency and profitability. They want to see that your business is healthy, growing, and able to pay off debts. A higher operating income means your business is more likely to pay back creditors. Net income is the bottom-line profit of a business after all expenses are subtracted, including interest and income tax.

- Depreciation only becomes “real money” when writing it off on your taxes or during the sale of a potential property.

- Online Store OwnersOnline Store Owners It’s easy for anyone to start their own online store with Divi.

- EBITEarnings before interest and tax refers to the company’s operating profit that is acquired after deducting all the expenses except the interest and tax expenses from the revenue.

- Non-operating income is income unrelated to a company’s day-to-day operations.

StocksToTrade has killer charts and customizable scans that can help you find the best stocks that fit your trading strategies. It also has an add-on feature called the Breaking News Chat where stock news is curated for you and sent directly to your inbox. Get it now so you don’t miss out on any price-altering news catalysts.

Income Taxes

Operating revenue gives you information about the company’s core operations and how this is impacting your success. In contrast, operating income focuses on gains made from operational activities, net Operating Income Formula of all operating expenses. Of importance to note is that these two are also different from net income, also known as the bottom line, which accounts for operating income less non-operating expenses.

Different factors such as total revenue, revenue sources, and profit margin, among others, contribute. As such, generating revenues and having good cash flows is essential. However, investors generally prefer companies with an increasing operating income as it shows that they can manage their production and overhead costs well. For most businesses, an operating margin higher than 15% is considered excellent. Operating income can be calculated by taking the difference between the gross income of a company and its operating expenses.

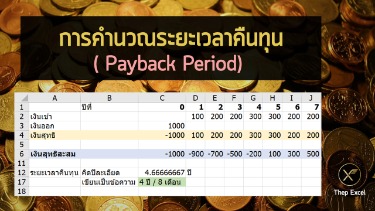

What is the Net Operating Income Formula?

During the year, a bad storm blew a tree over on one of the business’s storage sheds. Insurance wouldn’t completely cover the damages, so Philip had to report a loss of $20,000. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.