Stablecoins are cryptocurrencies whose values are tied to those of real-word assets such as the U.S. dollar. Thanks to the collateralized debt denominated in Ether , DAI stablecoin is also able to keep its value in check. The Collateralized Debt Positions are the smart contracts on the Maker protocol used to ensure price stability.

Stablecoins are built to not fluctuate in price while still giving users the benefits of crypto. We believe everyone should be able to make financial decisions with confidence. Bitcoin belongs to the more volatile class of cryptocurrencies. The launch of BUSD was on the fifth of September 2019 and it was aimed at bringing the stability of the dollar onto blockchain technology.

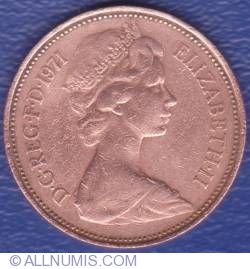

Tether (USDT)

For example, to borrow $5 of a crypto-backed stablecoin, you may need to “put in” $10 of another crypto asset as collateral. If the underlying crypto asset loses its value, you still have a built-in cushion of $5. In general, this volatility makes crypto-backed stablecoins less reliable than fiat-backed stablecoins. The mechanism offers a smoother, continuous liquidation process as opposed to a single, drastic event that sometimes causes turmoil and huge losses on lending protocols when cryptocurrency prices crash. To develop the new QCAD stablecoin, Stablecorp followed the guidance released by the Canadian Securities Association to ensure that it met global regulatory standards. The company also collaborated with an international stablecoin standards group to establish the token as fiat-backed with independent attestations of reserves that will be done on a monthly basis.

The increased market participation has also grown the trading volume and market capitalization. This leads to more liquidity, which makes the crypto market more efficient. Increased efficiency also brings more accurate asset pricing, resulting in fairer asset prices,tighter bids and ask spreads. Apart from being able to stabilize price volatility, stablecoins are also supported by multiple sources of assets. It could be a traditional currency like the US dollar, commodity, precious metals, or algorithmic functions, or other cryptocurrencies.

- To develop the new QCAD stablecoin, Stablecorp followed the guidance released by the Canadian Securities Association to ensure that it met global regulatory standards.

- In these roles, Andy has seen cryptocurrency develop from an experimental dark-web technology into an accepted part of the global financial system.

- At the moment, TUSD is being used to farm SUI, and as a result, TUSD has become one of the most in-demand tokens right now.

- The interest in stablecoins is that they are built to withstand volatility in a way that other cryptocurrencies aren’t, but still offer mobility and accessibility.

DOT is not showing any of that after bears breached the dams and flooded the area around $5.75. The author has not received compensation for writing this article, other than from FXStreet. Sui is an upcoming layer-1 blockchain that is being developed to support the growth of DeFi and GameFi markets by offering instant finality for transactions. Noted to be the native token of this blockchain, SUI is currently undergoing farming, which is kind of similar to an Initial Coin Offering . SUI farming led to heavy borrowing of the TUSD pair, resulting in the stablecoin being depegged.

Earn

Bitcoin and other cryptos have several benefits to offer investors and traders, and users and that include making transactions openly with no trust issues or the need for a third-party intermediary. However, the wild volatility of these cryptocurrencies can be the most obstructing roadblock for users. However, there have also been several stablecoins that have lost their peg entirely. Among fiat-backed stablecoins, Steem Dollars is a notable example.

At the moment, the market is kinder to the cryptocurrencies that are witnessing some or other kind of hype and trend. PEPE reinforced the notion that the only qualifying factor for a hit crypto at the moment is demand, as fundamentals do not seem to matter. Integrate USDC into your app or dApp today – USDC is a programmable digital dollar that’s open-source, composable, and accessible for anyone to build with. Circle is regulated as a licensed money transmitter under U.S. state law just like PayPal, Stripe, and Apple Pay. Circle’s financial statements are audited annually and subject to review by the SEC. Those familiar with the crypto industry know that reputation is a vital factor to consider when determining the viability of a product or platform.

All cryptocurrencies are are based on similar blockchain technology, which enables secure ownership of digital assets. Cryptocurrencies circulate on decentralized networks that use cryptography to guard against counterfeiting and fraud. Andy Rosen covers cryptocurrency investing and alternative assets for NerdWallet. He has more than 15 years of experience as a reporter and editor covering business, government, law enforcement and the intersection between money and ideas. In these roles, Andy has seen cryptocurrency develop from an experimental dark-web technology into an accepted part of the global financial system.

Featured Articles

Although it will be affected by any fluctuations that occur to its pegged asset, these are likely to be far less dramatic than those which impact the price of Bitcoin, Ethereum, and other major cryptos. Centralized exchanges may only list fiat-backed stablecoins like USDC, Tether, and others. You may not be able to buy them directly, but you should be able to exchange them from ETH or other cryptocurrencies that you can buy on the platform. Stablecoins can also be collateralized by other cryptocurrencies. The biggest example in this category is the DAI algorithmic stablecoin, which is pegged to the U.S. dollar but is backed by Ethereum and other cryptocurrencies.

New Venmo feature lets users transfer crypto to outside wallets—and to each other – Fortune

New Venmo feature lets users transfer crypto to outside wallets—and to each other.

Posted: Fri, 28 Apr 2023 16:00:00 GMT [source]

The bill envisions a larger role in the market for state regulators, despite the fact that the vast majority of states do not have a stablecoin regulatory framework in place yet. Republicans on the House Financial Services Committee on Monday released a new draft of legislation to regulate stablecoin issuers. Similarly, if the price is starting to exceed $1, the algorithm will increase the circulating supply to help bring the price lower. Each of these categories has different properties that make them suitable for a range of different purposes.

Examples of stablecoins

The Tron founder was warned by the Binance CEO not to farm any SUI with his TUSD deposits. Consequently, TUSD began to depeg, hitting the high of $1.2 against USDT’s $1 peg. Furthermore, thanks to Binance’s promotion of the stablecoin by making BTC/TUSD a zero-fee pair, TUSD has become one of the most highly traded tokens despite being relatively unknown.

These stablecoins are centralized, which parts of the crypto community may see as a drawback, but it also protects them from crypto volatility. Gold has long been seen as a hedge against stock market volatility and inflation, making it an attractive addition to portfolios in fluctuating markets. Digix is a stablecoin backed by gold that gives investors the ability to invest in the precious metal without the difficulties of transporting and storing it. This functions similar to a traditional wallet, but instead of paper currency, it holds proof of your cryptocurrency. Devices, programs on an app or website or services offered by crypto exchanges can all be used as wallets.

As the name implies, stablecoins aim to address this problem by promising to hold the value of the cryptocurrency steady in a variety of ways. Though Bitcoin remains the most popular cryptocurrency, it tends to suffer from high volatility in its price, or exchange rate. For instance, Bitcoin’s price rose from just under $5,000 in March 2020 to over $63,000 in April 2021 only to plunge almost 50% over the next two months.

The Motley Fool owns shares of and recommends Bitcoin and Ethereum. We pored over the data and user reviews to find the select rare picks that landed a spot on our list of the best stock brokers. Some of these best-in-class picks pack in valuable perks, including $0 stock and ETF commissions. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

These what is true investment finances are less stable than fiat-backed stablecoins, and it is a good idea to keep tabs on how the underlying crypto asset behind your stablecoin is performing. One crypto-backed stablecoin is dai, which is pegged to the U.S. dollar and runs on the Ethereum blockchain. Stablecoins have cemented their status as a vital part of the crypto ecosystem.

US needs to regulate stablecoins to keep a strong dollar: Stellar CEO – Cointelegraph

US needs to regulate stablecoins to keep a strong dollar: Stellar CEO.

Posted: Wed, 12 Apr 2023 07:00:00 GMT [source]

USDC is a fully-reserved stablecoin, which is a type of cryptocurrency, or digital asset. Unlike other cryptocurrencies that fluctuate in price, USDC is designed to maintain price equivalence to the U.S. dollar. USDC is a stable store of value that benefits from the speed and security of blockchain technology. In most cases, meme coins are distributed via automated market makers . This means when a token first launches, the development team creates a new liquidity pool for investors to use to purchase the token. Liquidity pools are smart contracts that allow investors to swap cryptocurrencies without the need for a third party order book or counterparty.

StableCoin

These are the key disadvantages to consider before deciding whhttps://cryptolisting.org/er to invest in any type of stablecoin. You should review a few different platforms to find the best cryptocurrency exchange for your needs. Exchanges have widely different user interfaces, fees and rules. A little research can help you feel comfortable with the exchange you choose. Lend stablecoins and earn interest and $COMP, Compound’s own token.

Also, USD Coin is designed to let dollars move globally from your crypto wallet to other individuals, exchanges, and businesses. As mentioned earlier, meme coins concentrated in the hands of a few investors or the development team are risky ventures. Therefore, ensure that no single entity controls over 5% of the token’s supply. There are now hundreds of meme coins all vying for the attention of crypto investors. While many may look legitimate, a majority of meme-inspired cryptocurrencies are simply scam projects designed to capitalize on the growing meme coin trend. You can reduce the risks involved by ensuring that the project is not prone to rug pull scams.

Hence, it is advisable to unravel the identities of the core contributors of the project and their track records. Note that it may be impossible to find information about the members of the development team due to their decision to remain anonymous. In such cases, you can base your research on the design decisions of the team, especially tokenomics. As such, it is critical to research the long-term focus of the project in question and how the project team plans to keep community members engaged with the network. You can do this by perusing the project’s whitepaper, its roadmap and following updates on the official social network accounts.

CDPs give users the access to securely lock their collateral assets while generating DAI. When looking at the prices of stablecoins on digital asset platforms, you will notice that stablecoins often do not remain “stable” at $1.00. For example, at the time of writing this article, the Gemini Dollar , USDD , and Stably USD were trading at $0.992, $0.991, and $0.9995, respectively.

The Financial Stability Board proposed a framework for cryptocurrencies to the world’s largest economies that calls for stricter regulation of crypto assets, namely stablecoins. Stablecoins aim to provide an alternative to the high volatility of popular cryptocurrencies, including Bitcoin , which can make cryptocurrency less suitable for common transactions. Such reserves are maintained by independent custodians and are regularly audited. Tether and TrueUSD are popular stablecoins backed by U.S. dollar reserves and denominated at parity to the dollar. All this volatility can be great for traders, but it turns routine transactions like purchases into risky speculation for the buyer and seller. Investors holding cryptocurrencies for long-term appreciation don’t want to become famous for paying 10,000 Bitcoins for two pizzas.

Bitcoin price shows no signs of bullish momentum as it hovers below a critical psychological level. This lack of buying pressure could be a result of exhaustion after BTC’s impressive rally in Q1 of 2023. Polygon and Arbitrum blockchains witnessed a spike in their on-chain activity, in terms of active addresses, compared to April 2023. The increase in active addresses was accompanied by a spike in ARB price over the past thirty days. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. FXStreet and the author do not provide personalized recommendations.

Experts say the DAI stablecoin is overcollateralized, which means that the value of cryptocurrency assets held in reserves might be greater than the number of DAI stablecoins issued. Get started in minutes on Binance, the largest cryptocurrency exchange in the world. There are different options available for buying cryptocurrencies at Binance. You can either make a fiat deposit or use a debit/credit card. Traders and investors can earn interest with some fiat or gold-backed stablecoins via lending and staking.