Content

On the other hand, a real wage is a wage adjusted for inflation. If your nominal wage increases slower than the rate of inflation, then your purchasing power will decline. Since it is an expense, it is also recorded under operating expenses in the Income Statement of the company. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Is the revenue account Professional Fees increased with a debit or a credit?

Is salaries payable payable a current liability?

This account is classified as a current liability, since such payments are typically payable in less than one year. The balance in the account increases with a credit and decreases with a debit.

It is debited, when the amounts thus deposited are refunded to the employees, by crediting a cash account. The employer’s contribution to the company savings plan in the form of an additional payment is recorded as payroll costs in account 647 » Other social charges » . The amount of payments made to these committees is debited to a cash account. Accounts payable are a liability account, representing money you owe your suppliers.

Salary Payable vs Salary Expense

Assuming the existing amount in the debit section of the wages expense account is $0, you would add the $3,780 to it. And the ending balance of accrued wages and salaries payable would remain $3,780. In this scenario, the salaries payable is the same as salaries expense. However, the debit side of the transaction goes directly into the income statement account. However, the salaries payable account will hold this amount until a company pays its employees. Once that transaction occurs, the company can remove the balance from the salaries payable account.

Overtime is an amount based on an employee’s work and their salaries and wages. Usually, over time depends on the number of hours an employee works beyond a set limit. For example, an employee may work 8 hours every day as a part of their employment contract. If they put in 9 hours, the additional hour will qualify as overtime. The question that arises pertaining to salaries and wages being a debit transaction or a credit transaction clouds the judgment of several different accountants.

What if Salary Payable Subsequently Not Pay to Staff? How to Account for It

The worker is paid per hour for a set amount of hours per week. If they go over the set amount of hours, then they are usually paid overtime. Overtime pay can sometimes be higher than the regular hourly pay; sometimes 1.5x the hourly pay. Also, wage expenses during the Christmas/holiday season may be higher as companies hire more workers to meet the increased demand for shopping.

- Get instant access to video lessons taught by experienced investment bankers.

- We also reference original research from other reputable publishers where appropriate.

- In contrast, salaries payable is a current liability in the balance sheet.

- Then, show the journal entry for the above transaction on January 27, 2020.

- Since it is an expense, it is also recorded under operating expenses in the Income Statement of the company.

- So, the last salaries before the end of the reporting period were paid to the employees on December 27, 2019.

So, for February 2022 the accounting period ends on February 28, 2022, and anyone who gets paid for work done until the 20th will not be paid for the remaining eight days. Find the ending balance. The sum of all the amounts credited in the accrued wages and salaries payable section represents its ending balance. Account 425 » Employees – Advance payments on account » is debited with the amount of advances paid to employees by crediting a cash account.

Balance Sheet: Accounts, Examples, and Equation

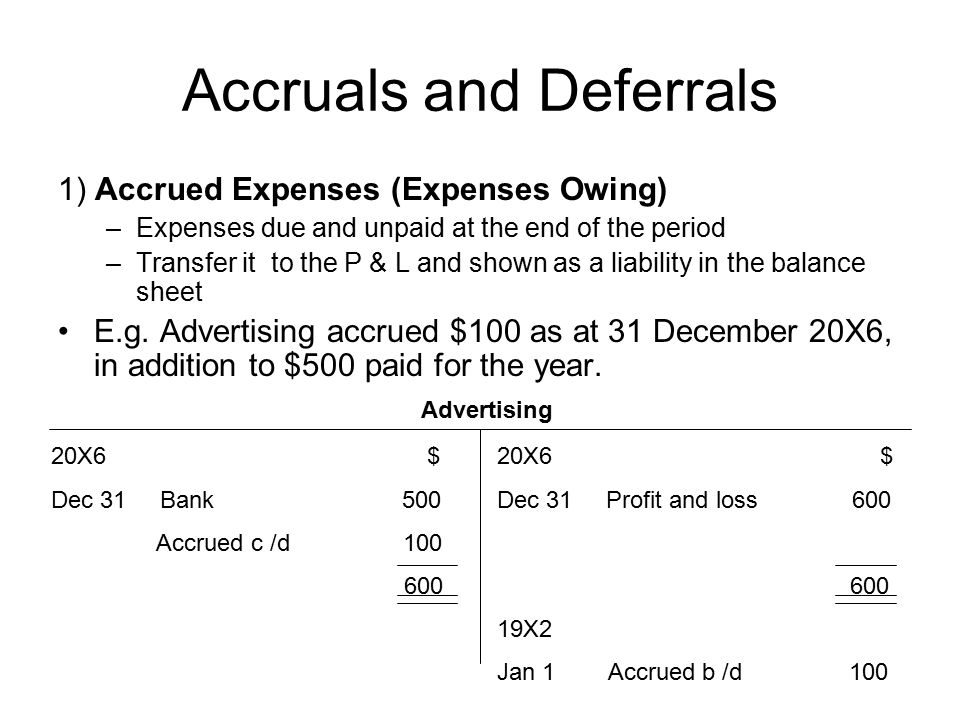

These features meet the definition of liabilities set in accounting through the contextual framework. Salaries payable refers to the amount a company owes to its employees due to their past work. This amount represents an obligation for the company to pay those employees in the future. Primarily, salaries payable come from the salaries calculated for employees at each calculation date. Companies record this amount in their books due to the timing difference in payments.

By this definition, if any wages are incurred in a year corresponding to the revenues that have been earned in the given year, they are then declared as expenses for the current period only. How does the sale of merchandise on 90-day credit terms affect net income and cash from operations? Explain how cash flow data complement the income statement and balance sheet. How does the accrual of sales commissions affect net income and cash from operations? How does the accrual of interest on a bank loan affect net income and cash from operations?

Between salaries accrued and salaries paid, the impact on the financial statement is not that significant. Since salaries and wages incurred are declared on the Income Statement regardless of the payment schedule, it is important to note the fact that the impact on profitability is zero. Since the salary expense is incurred in the month of December 2020, it will still be disclosed in the financial statements, since it is relevant to the current year. However, since it was not paid out of the bank until 10th January 2021, it would be declared as a Current Liability , in the financial statements prepared on 31st December 2020. The recognition of accrued wages is meant to record the incurred yet not paid wage expense in a given reporting period. How does the payment of an account payable affect net income and cash from operations?

- Salaries payable is a liability account that shows the accrued wages.

- How does the write-off of an uncollectible receivable affect net income and cash from operations?

- Is the revenue account Professional Fees increased with a debit or a credit?

- Salaries payable and salaries expense are usually the same amounts.

- For example, assume employees are paid every Friday and December 31 lands on a Tuesday.

- Commonly, it will be paid within 12 months from the year-end of financial statements, and it is not generally more than that.

Salaries Payable is an account that is presented in the Liability portion of a Balance Sheet. It is the account that records the salaries that the company owes its employees. But for small to middle size organizations, one ledger account is more than enough to record all their payables related to their employees. Salary expense is the wage that an employee earns during the period, what are salaries payable irrespective of whether it is paid or not by the company. While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status.

What type of account is salaries payable quizlet?

During the month, USD5,000 is paid against the previous month’s salary. For the above transaction, we would have to record a Journal Entry on Dec 31st for the Salaries that have accrued from Dec 26,20X7 to Dec 31st, 20X7. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

The balance in the account represents the salaries liability of a business as of the balance sheet date. However, companies that are just starting up or those whose business model is ineffective may be spending more on expenses than they are making. These will then result in the reduction of their assets and net worth and an increase in their liabilities, thus, they will be incurring losses instead of profits. The company’s balance sheet will show this reduction in assets and increase in liabilities while the income statement will show the operating loss. Therefore, salaries and wages payable are considered as payments that need to be made to the employees of the company in order to make sure that the company settles these accounts. ParticularDebitCreditSalaries and WagesxxxBankxxxThe journal entry above shows that salaries and wages are paid to the employees.